Big data analytics is playing a progressively important role in insurance business. Working alongside adjusters analytics can flag claims for the closer inspection, significance handling and more.

Opportunities for Insurers: Operationalizing Analytics

Fraud – The one out of ten insurance claims is fake. Most fraud solutions on market today are rules based. Unluckily, it is too easy for fraudsters to operate and get around rules. Predictive analysis as on the other hand can use a combination of rules, modeling, data base searches, text mining, and exclusion reporting to recognize fraud sooner and more successfully at each stage of claims cycle.

Settlement – The lower costs and ensure fairness the insurers often implement fast track processes that settle claims instantly .And also settling a claim on the fly can be costly if you overpay. Any insurer who has seen an impulsive of home payments in an area hit by the natural tragedy knows how that works. By analyzing claims and claim histories so that you can optimize limits for the instant payouts. Big Data – Analytics can also shorten claims cycle times for the advanced customer satisfaction and decrease labor costs. It also ensures significant savings on things such as the rental cars for auto repair claims.

Activity – Data excavating techniques cluster and the group loss characteristics to score, order and assign claims to the most suitable adjuster based on the experience and loss type. In some cases, claims can even be spontaneously arbitrated and settled.

Loss reserve – When a claim is first reported then it is nearly impossible to guess its size and duration. Insurance Analytics can more precisely calculate loss reserve by comparing it with a loss that have similar claims. So whenever the claims data is updated, analytics can reassess the loss reserve so you understand exactly how much money you need on hand to the meet future claims.

Litigation – An important portion of the company’s loss modification expenditure ratio goes to defending the disputed claims. Insurers can use insurance analytics to calculate litigation propensity score to determine claims which are more likely to result in litigation. Then assign those claims to more senior adjusters who are more probable to be able to settle claims sooner and for lower amounts.

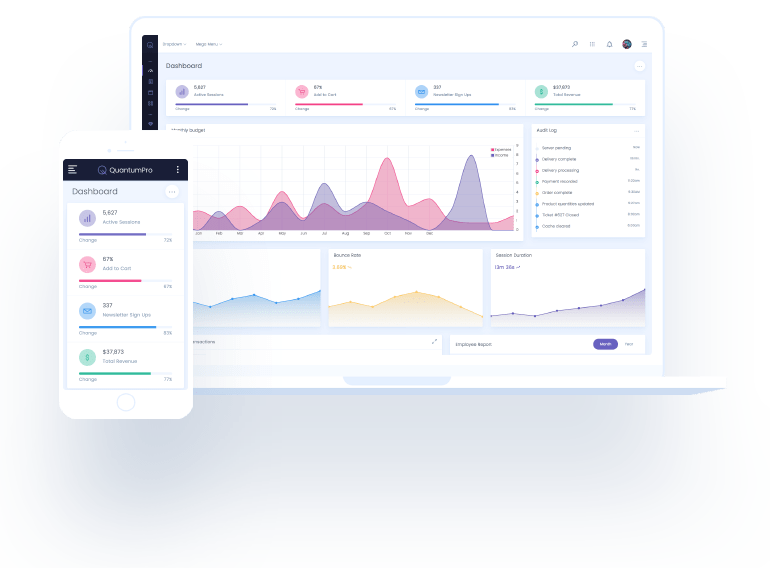

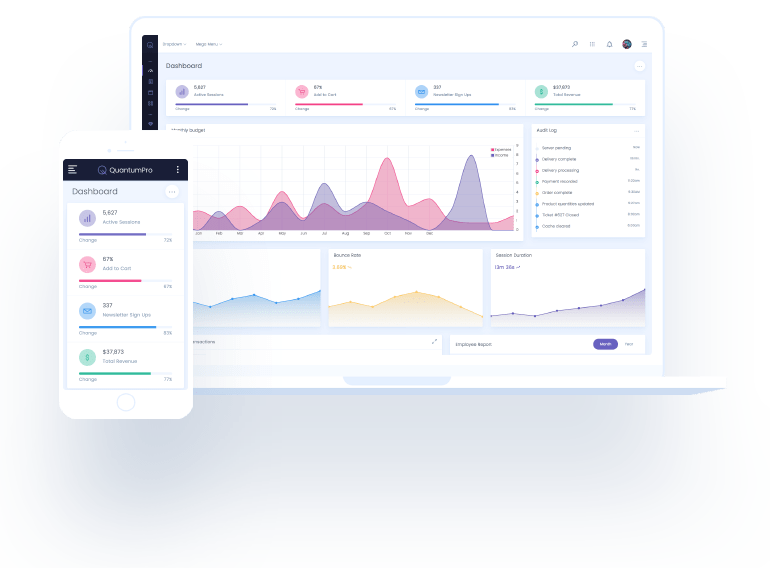

Bilytica – Business Intelligence Insurance analytics make analytics a part of your claims processing, as insurance becomes a commodity it becomes more important for carriers to differentiate themselves. By adding analytics to the claims life cycle can deliver a measurable ROI with cost savings.